Welcome to the Mideast Money newsletter, I’m Adveith Nair. Join us each week as my team and I chronicle the intersection of money and power in a region that’s become one of the most influential in global finance.

This week, we look at Dubai’s position as a financial center, US-UAE talks on artificial intelligence and examine why many expats are considering a move to a 7,000-year-old city.

Dubai has emerged as a hub for the world’s wealthiest people and some of the largest firms. For one data point on the boom, look to hedge funds — the city now hosts local offices of close to four dozen firms with assets exceeding $1 billion each — and the industry employs more than 1,000 people.

“We have 63 hedge fund clients, 44 of which exceed the $1 billion assets under management mark,” Salmaan Jaffery, chief business development officer of Dubai International Financial Centre Authority, told Joumanna Bercetche on Bloomberg TV.

Dubai a ‘Thriving Ecosystem’ for Wealth: DIFC Authority

“Unlike a few years ago, this comprises a very significant number of people deploying capital out of the region, as opposed to simply being frontline salespeople or relationship managers,” Jaffery said.

That number might inch higher, after London-based Capricorn Fund Managers announced it’s starting a hosting platform to help hedge funds and investment companies quickly start operations in Dubai.

Dubai has long been the Middle East’s business and finance hub, with firms around the world using the city as a base to tap into large pools of wealth regionally and lucrative markets elsewhere — the DIFC is now back into a ranking of the top 20 global hubs after dropping out last year.

Employee numbers have surged by two-thirds since 2019 to around 44,000 by June, according to data provided by the freezone. Jaffery added that the quality of financial services workers, including bankers and senior asset and portfolio managers, coming to Dubai over the past five years was “unprecedented.”

Dubai’s International Financial Hub Is Growing

Source: DIFC

But there is competition.

Neighboring Abu Dhabi — home to $1.5 trillion in sovereign wealth capital and 6% of the world’s oil reserves — has unveiled a string of measures to draw in the biggest names of finance, with some success. Saudi Arabia is intensifying efforts to get global firms to set up in its capital, even inserting language asking about regional headquarters for bankers wanting to win business with its $925 billion wealth fund.

When it comes to Dubai, one big draw for firms is private wealth. According to a September report from Henley & Partners, the city is home to 212 centimillionaires — 15th in the world and first in the region. This newsletter has previously covered the United Arab Emirate’s position as a magnet for the rich — more than 6,700 millionaires are expected to move to the Gulf nation this year — and the ensuing boom in private banking.

Last week saw a string of developments in this space, including from Nigerian billionaire Aliko Dangote who is setting up a family office in Dubai. Meantime Santander unveiled a new DIFC outpost catering to “the rapidly growing high-net-worth and ultra-high-net-worth communities across Dubai and the region.”

“The city is home to region’s highest concentration of wealth and continues to experience the highest inflows of millionaires, centimillionaires and billionaires,” Jaffery said. “Put that together with the managers and you have the region’s largest and deepest thriving ecosystem for wealth,” he added, calling Dubai the capital of private capital.

A US trip — and the UAE’s AI push

Last week marked UAE President Sheikh Mohammed bin Zayed’s first trip to Washington as the country’s ruler. The diplomatic advisor to the Gulf leader set out the UAE’s main goal ahead of the visit — to bring up partnerships in artificial intelligence and technology.

“Sometimes people like to talk about some tensions in the relationship but the big story is that this is our most important strategic alliance,” Anwar Gargash had said at the time. When it comes to technology, “we have the finances. A lot of these AI projects and others need large pools of finance.”

Joining the president on his visit to the US was his brother, Sheikh Tahnoon bin Zayed. Alongside his roles as Abu Dhabi’s deputy ruler and the UAE’s national security advisor, Sheikh Tahnoon oversees a $1.5 trillion empire that includes the region’s most prominent AI firm G42.

During the trip, Sheikh Tahnoon, alongside US National Security Advisor Jake Sullivan, endorsed the Common Principles for Cooperation on AI, UAE state media reported, adding that the two sides intend to closely collaborate to advance safe, secure and trustworthy AI.

The Abu Dhabi royal also met with key names in the world of business.

“The UAE has an ambitious vision to become the country most prepared for the next stage in the field of artificial intelligence by investing in individuals, sectors and various partnerships,” Sheikh Tahnoon said in a post on X, following a meeting with Amazon founder Jeff Bezos. They discussed “opportunities for joint cooperation in the field of artificial intelligence and advanced technology.”

The Gulf country has already been pitching to become a regional hub and testing ground for AI, and could potentially back an ambitious plan by OpenAI CEO Sam Altman to expand systems for the technology.

Along the way, there have been concerns in Washington around the Gulf state’s ties to China. But earlier this year, Microsoft agreed to invest $1.5 billion in G42, after the Abu Dhabi-based company worked out a deal with the US government to end any cooperation with Beijing. The firms are now also establishing centers in the Gulf state focused on developing best practices and industry standards for the responsible use of the industry.

The US visit also included a meeting with the world’s richest man.

“We discussed with Elon Musk the latest developments in the field of advanced technology and artificial intelligence and ways to enhance joint cooperation,” Sheikh Tahnoon said on X. Musk, who set up AI startup xAI in early 2023, also co-founded OpenAI as a nonprofit and was its leading funder before resigning from the board in 2018.

Foreign direct investment into Saudi Arabia stagnated in the first half of the year, casting a shadow over Crown Prince Mohammed bin Salman’s plans.

Saudi Arabia Showing Static Growth in FDI

Source: Bloomberg, GSTAT

Saudi Aramco raised $3 billion through its dollar Sukuk bond sale, after drawing orders for over $22 billion.

Abu Dhabi wealth fund Mubadala is teaming up with Citigroup and Apollo Global in the fast-growing private credit market, agreeing to work together on $25 billion worth of deals over the next five years.

Advisory firm PJT Partners plans to increase its headcount in Saudi Arabia following the acquisition of Dubai-based deNovo Partners.

Exxon Mobil revealed it paid $7.41 billion in taxes and royalties to the UAE last year, more than any other country globally.

Abu Dhabi’s largest property developer will spend $408.4 million to upgrade its hotels to capitalize on the growing demand for luxury tourism. Meanwhile, the emirate’s airline has been forced to retrofit old Boeing jets amid a shortage of new aircraft.

Abu Dhabi is in talks to offer Kenya a $1.5 billion loan, in the latest in a series of bailouts the emirate has extended to African countries.

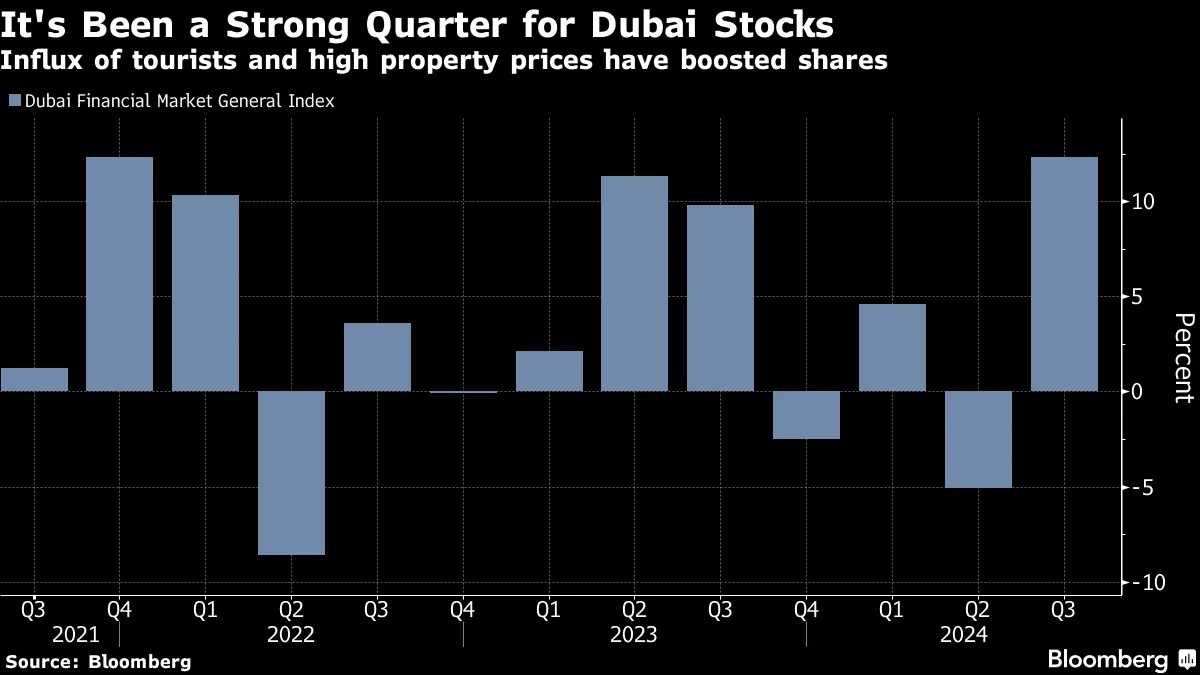

Dubai stocks have advanced 12% this quarter to the highest since 2014. Now, that rally looks set to cool.

Dubai is enforcing stricter rules for marketing crypto investments including prominent disclaimers.

Turkey’s finance minister told investors at a meeting in New York that tight fiscal policy will play a decisive role in the disinflation process.

Ratio of Turkey Budget Deficit to GDP

Forecasts are part of the government’s medium-term program

Source: Turkish Presidency of Strategy and Budget

Middle Eastern investors have deployed a record $9 billion in China this year just as other global firms retreat.

Here’re a few other stories that caught my eye:

Chinese stocks entered a bull market after their biggest surge since 2008, staging a remarkable turnaround with nine straight days of gains.

Bonus-starved bankers are jumping ship for private credit firms.

Buyout heavyweights are increasingly resorting to the old-fashioned way of making money — actually running the companies they’ve bought.

Hands-On Managers Are Driving Private Equity Returns

Improvements in operations are outweighing gains from financial engineering.

Source: Ernst & Young Global

The US commercial real estate market is coming back to life.

Property Prices Are Climbing Again

Commercial real estate prices rose 3% this year but are 19% below 2022 peak

Source: Green Street Commercial Property Price Index

The UK’s richest are fleeing the threat of rising taxes.

Rolex’s selling certified used watches — but you’ll still have to pay a lot.

Chart of the week

Dubai faces moderate risk of a bubble forming in its real estate market after home prices surged 40% since 2020, according to a report by UBS.

Dubai recorded the strongest increase in the risk score of all the cities analyzed in the annual Global Real Estate Bubble Index. Still, the emirate falls in the moderate risk category because of factors including rising household incomes, high proportion of cash buyers and rental yields that remain in the 6-7% range, economists Matthias Holzhey and Maciej Skoczek wrote in the report.

Dubai’s Real Estate Market Faces ‘Moderate’ Bubble Risk

Source: UBS Global Real Estate Bubble Index 2024

Note: Bubble risk score between 0.5 to 1 signals ‘moderate’ risk

Sharjah’s moment

With an increasing number of expats saying they’re being pushed out of Dubai due to soaring rents, neighboring Sharjah is looking to cash in.

The conservative emirate’s government loosened rules to allow foreign nationals to more easily buy property two years ago — and buyers are beginning to flock to the city.

Sharjah has long offered more affordable housing compared with Dubai, but much of its housing supply consists of old towers with few of the facilities typically offered by its glitzy neighbor.

That’s starting to change. Arada Developments, owned by the son of Saudi Arabian Prince Alwaleed bin Talal and a member of Sharjah’s ruling family, is building a $9.5 billion project.

Indian buyers now make up about 29% of home sales in Arada’s developments in Sharjah, up from 8.7% just a few years ago, according to data provided by the firm.

Buyers from Germany, Canada and the UK now comprise 10% of property purchases — those nationalities barely registered in Arada’s data before the 2022 law was passed.

Foreigners Flock to Sharjah After Ruler Loosens Laws

Indian buyers now make up 29% of home sales in the conservative emirate

Source: Data provided by Arada

The demand is helping boost prices in the 7,000-year-old city, and other developers are also seeing an opportunity.

One of positive impacts by Dubai Luxury Real Estate boom.